Coronavirus upends operations, revenue projections; but with viewership soaring network chief tells news staff to keep focused on the crisis

On a recent conference call, CNN chief Jeff Zucker urged editors and producers at the network not to shift focus from coronavirus news updates despite weeks of wall-to-wall coverage of the pandemic.

“You need to stay on the news,” Mr. Zucker said, according to a person who listened. “People are coming to CNN for the news right now.”

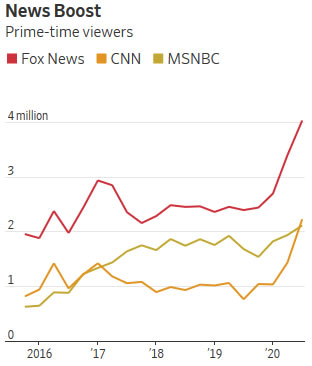

TV ratings suggest his hunch was on target. CNN and other cable news outlets could scarcely imagine that anything could juice viewership like the 2016 U.S. presidential election and its aftermath; but ratings have soared during the pandemic, reaching levels well above those when “Russian interference” and “Mueller report” dominated the news.

CNN has averaged 2.2 million total viewers in prime time through the first week of April, more than double its viewership in the fourth quarter of 2019, and roughly 57% higher than its election-season peak, according to Nielsen data. Fox News is up nearly 50% since the end of last year to over four million viewers, increasing its lead over its two main rivals. MSNBC has seen the smallest lift. The three networks’ websites all saw big audience gains, too.

Cashing in has been difficult for all the channels, however, as the economic fallout of the pandemic causes ad spending to collapse.

CNN has revised its ad revenue forecasts downward, people familiar with the matter said. Instead of a double-digit percentage increase in revenue this year, the network could be staring at a significant decline, one top media analyst said.

CNN’s digital arm is trying to entice ad buyers by offering to match their spending on public-service messages with free advertising that touts the social good companies are doing, one of the people said.

Chronicling the crisis for the public has been an odyssey. Anchors and producers committed to telling Americans the importance of social distancing and staying home are themselves trying to figure out how to perform their jobs safely night after night. CNN is using skeleton crews of producers in Atlanta and New York after encouraging many of its employees to work from home.

In some cases, anchors have begun using one-person “flash studios” at the production facility instead of their usual large, glass-walled setup with multiple camera operators, people familiar with the matter said. Crews at the facilities volunteer for their stints, the people said, and no one is being forced to show up.

Despite the precautions, two prominent CNN anchors—Brooke Baldwin and Chris Cuomo—contracted the virus. Mr. Cuomo, perhaps the network’s highest-profile coronavirus chronicler, has documented his status nightly while broadcasting from home. Anderson Cooper, who like Mr. Cuomo is New York-based, did his show at home for a time after a staffer was infected. The company declined to provide a count of confirmed cases among its staff members.

“I don’t think we realized how crazy this would be,” one CNN employee said. “Cuomo’s show is from his basement. Nobody expected that.”

Mr. Zucker, who serves as news and sports chairman of CNN parent WarnerMedia, a unit of AT&T Inc., has always doubled as an editor in chief for the network. And he has stuck with that role for the coronavirus story. He has suggested story ideas in emails to lieutenants, on calls with producers and in town-hall meetings with staff.

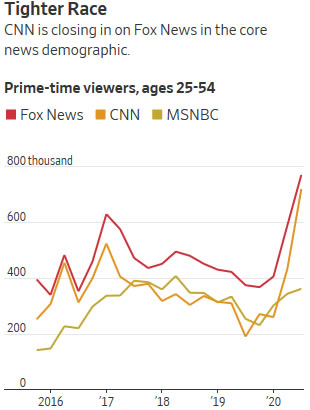

Last year CNN sank to third place in cable-news ratings. But its recent jump has put it within shouting distance of Fox News in the core news demographic of those 25 to 54 years old with an average of about 50,000 viewers separating them in prime time through the first week of April, according to Nielsen data. For the year thus far, Fox has a larger lead.

Hosts at Fox News have come under fire for playing down the coronavirus threat for weeks in the network’s coverage. The network has said criticism of its coverage draws selectively from statements made on its opinion programs.

Both networks have blown past MSNBC in the core demographic. MSNBC, which is owned by NBCUniversal, a division of Comcast Corp., surged after the 2016 election, becoming a home for viewers seeking fiery criticism of the Trump administration. A spokeswoman for MSNBC declined to comment.

Fox News owner Fox Corp. and Wall Street Journal parent News Corp share common ownership.

Before the pandemic, the CNN channel was expected to generate about $1.7 billion in revenue this year, according to projections from Kagan, a unit of S&P Global Market Intelligence, with ad revenue expected to increase about 15% from last year to $667 million. An analyst for Kagan, Derek Baine, said he now expects CNN’s ad revenue could decrease in the double-digit percentage range this year.

Many industry executives say the cuts to ad spending by beleaguered businesses will be larger than those during the 2008 financial crisis or following the Sept. 11, 2001, terrorist attacks.

“Huge chunks of the advertising market are going to disappear in the second quarter,” said Craig Moffett, an analyst at MoffettNathanson, which analyzes publicly traded media and telecom companies. The research firm estimates that ad revenue at Turner, the division of WarnerMedia that includes CNN as well as TNT and TBS, will decline by between 5.5% and 16% during a deep recession.

Election-related ads are a CNN mainstay, but total U.S. ad spending on the current presidential election fell sharply during the last week of March to $4.8 million after reaching a high of $119.8 million for the last week of February, according to Advertising Analytics, an analytics firm that tracks political spending.

Political ads are likely to bounce back, said John Link, director of sales at Advertising Analytics. “I put the presidential lull down to the fact that the field has been dwindled down to a presumptive candidate,” Mr. Link said. “I believe that you’ll start to see an uptick come May.”

—Suzanne Vranica contributed to this article.

Write to Benjamin Mullin at Benjamin.Mullin@wsj.com